Prepaid Card

Up to 45 currencies supported

For your global transactions.

Fixed buy rate

for US Dollar 3.75.

Cash Withdrawal

Access up to 30% of your credit limit worldwide.

Travel Plus Card

The Travel Plus Card gives you the ability to load funds directly from your current account. This allows you to purchase various currencies, load the available wallets on the card, and use them for purchases via point-of-sale devices and online stores, as well as for cash withdrawals from ATMs anywhere in the world.

Travel Plus Card: Your Global Multi-Currency Companion

Enjoy exclusive travel and shopping experience Travel Plus card is an innovative way to carry multiple currencies in one single card. It will allow you to use it in purchases through Point-of-Sale machines and electronic stores, as well as cash withdraw anywhere in the world. Add and Charge your card in the following currencies:

Add and Charge your card in the following currencies:

Card Features

Get key features and conveniences with card, designed to enhance your banking experience.

Cash Withdrawal

Access up to 30% of your credit limit worldwide.

Instant Notifications

Free alerts to track your finances effortlessly.

Global Access

Use at 30M+ POS and 900,000 ATMs worldwide.

3D Secure

Enhanced online shopping protection with one time passwords.

Up to 45 currencies supported

For your global transactions.

Fixed buy rate

for US Dollar 3.75.

NFC (Near Field Communication)

NFC, Apple Pay, Mada pay, and Samsung Pay services for easy, tap-to-pay transactions.

Life Style

- Free Card Issuance Fee for the first card.

- Fixed buy rate for US Dollar 3.75

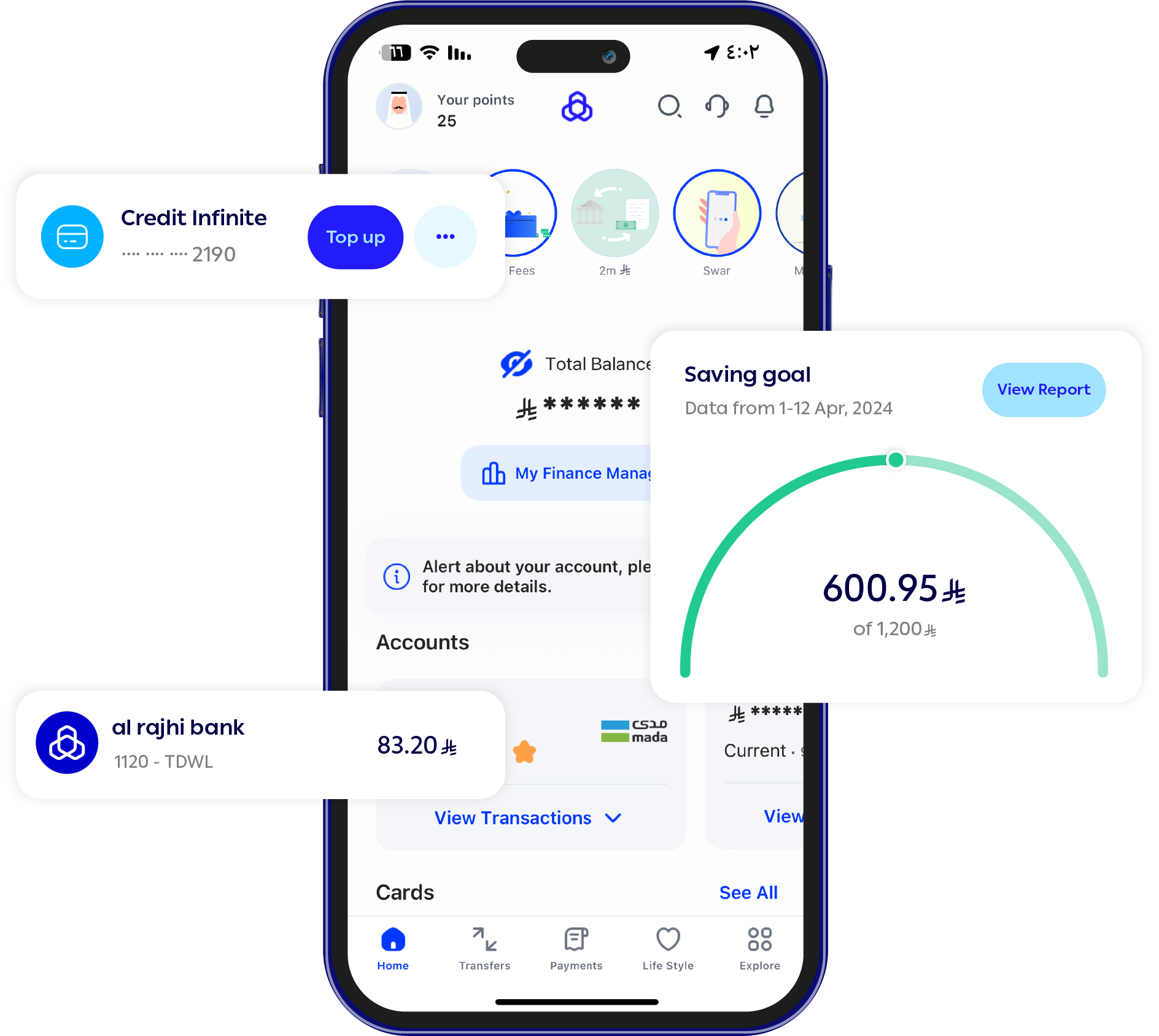

- Easy transfer from current account to any card currency through Almubasher and alrajhi bank App

- “Visa Checkout” The Easier Pay Online Service

| Schedule of Charges | Fee |

|---|---|

| Card issuance | Free Card Issuance Fee for the first card. |

| Annual fees | § 150 |

| Replacement Card fee | § 15 |

| Wrong Dispute fee | § 25 |

| Cash Withdrawal Fee (from alrajhi ATMs) | 3% of the transaction amount with a maximum of SAR 75 |

| Cash Withdrawal Fee (from Other Local Banks) | 3% of the transaction amount with a maximum of SAR 75 |

| Cash Withdrawal Fee (from International Banks) | 3% of the transaction amount with a maximum equivalent of SAR 75 |

| Cash withdrawal fee for other currencies than (AED, €, £ & $) | 3% of the transaction amount with a maximum equivalent of SAR 75 |

| Cash withdrawal fee from ATMs in one of the card’s currencies when there is not enough credit available (debited from the US dollar wallet) | 3% of the transaction amount with a maximum equivalent of SAR 75 |

| Cash withdrawal fees from ATMs in other currencies (debited from the US dollar wallet) | 3% of the transaction amount with a maximum equivalent of SAR 75 |

| Purchase fees for transactions in one of the card's currencies if there is not sufficient currency balance (debited from the US dollar wallet) | 1% of the transaction amount |

| Purchase fees for transactions in a currency not available in the card (debited from the US dollar wallet) | 2% of the transaction amount |

| Fee to add a new currency to the card | (§ 25) |

* Effective Date July 19, 2025

*Customer is eligible for One card with no issuance fee “Limited Time Offer”, and any additional card will be charged issuance / annual fee.

Bank Account

Existing bank account with alrajhi bank.

National ID/Iqama

Copy Of Valid ID (National ID/Iqama)

Application Form

Fill & submit application form.

Terms of Conditions

Approve the terms and conditions

How to apply

Apply Now

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby

Frequently Asked Questions:

Get answers to the most frequently asked questions about our service.